The Bank has called your Loan due now

What can you do? Has the bank called your loan due immediately? It is a very stressful scenario.

You may have received a letter or call demanding that you payoff your business or personal loan immediately. Very few businesses can afford to satisfy a debt from one day to the next.

Consider the top 3 ways further below to fix the problem, avoid a quick default, and save your collateral.

Call 919-771-4177 for more info.

Apply above to: Payoff or Refinance your company debt now – before it is in default.

Payoff the Full Balance

Refinance and Extend the term

Negotiate to Restructure or Settle

Bank delinquency rates have gone up in the 1st Quarter of 2020. You can review the Federal Reserve’s Charge-Off and Delinquency Rates report on loans and leases at commercial institutions below.

Quarterly financials, credit score checks and other reviews are often requested.

If your overall situation has deteriorated, you may be at a high risk of a traditional financial institution calling your loan payable immediately.

Familiarize yourself with your best options beforehand.

The Bank has called your loan due and payable, immediately

3 ways to work it out

1. Attempt to renegotiate the contract:

Call and ask for extra time to respond to them. When ready, ask if they will restructure the existing debt and extend the terms.

Calculate in advance the highest payment you can afford and ask if they can extend the contact to match that. Provide data and documentation to support your request. This can include recent bank statements, a current budget such as a profit & loss statement, or tax returns.

Show your calculations for the maximum payments you can make. Provide your supporting documentation and make your request. Ethical lenders will arrange a workout to avoid a quick payoff demand you cannot meet.

Negotiation Example:Your monthly payment is $800 and you have 30 more to make. The balance is $24,000. After looking at your current and future cash flow, you calculate that you can afford $500 per installment. Ask if you can extend the term of that contract from 30 to 48 and counter that you can manage $500 per month. If they will not agree, contact or apply with us for payoff or refinance options.

2. Payoff the Loan

Paying off the loan is usually the best option but the hardest to do within days. Borrowers that have this option available sometimes do not choose a payout.

Many do not want to sacrifice their hard earned assets and liquidity to payoff a debt that is already in default. At that point, some borrowers would rather negotiate a settlement or protect their assets through a bankruptcy filing.

Primary real estate held as collateral will make the borrower want to avoid a default, if they can. When the borrowers home, stocks or other valuable collateral is at stake, then borrowers strongly consider a payoff using other resources. This avoids a larger loss through total forfeiture of their collateral.

3. Refinance the Debt

Paying off the existing balance is also the hardest way. A refinance can often be approved by using a longer term asset based program to refinance. Borrowers that qualify for 24 months or longer improve their cash flow up to 75% or more every month. They also may get a weekly or monthly payment.

For Example:The original amount of $50,000 has been delinquent. The current balance is $15,000 and the bank has called the loan due. Regular payments are $1,500 per month. You have 10 installments left but cannot make them. It will take your business at least 90 days for sales to get close to normal, but the lender won’t give you the extra time to recover.

If you can refinance the contract with a 24 month asset based loan, then your monthly amount due is $625 per month. You have reduced and improved your cash flow by 140%. A refinance can be very successful in this type of situation.

Warning Signs

With the nation’s top economists forecasting that the economy will contract 6% overall in 2020 including a sharp 2nd Quarter decline, bank delinquency rates have increased. The chances are higher for personal and business loans to be called by lending institutions to protect their portfolios.

Data Secure 15 Second Request Form Here.

Call 919-771-4177 for more info.

FAQ Bank called loan due.

Can the bank call my loan due?

Many banks have provisions or covenants in their contracts that allow them to call the loan anytime and for any reason. Most borrowers are not aware of this.

What should I do if I get a payoff demand letter?

Always negotiate professionally and in good faith regardless of the situation. If you end up in court this can help your case. Make a documented case for why you cannot pay. Offer to renegotiate or settle the debt if you are able to. Use any professional legal assistance available.

What can I do if the bank wont negotiate or settle?

Pay the loan off or refinance if you can. If you cannot, then get legal representation to represent you and continue to negotiate. Often the lender will make a final offer before a court case. Arbitration written into the contract may call for a different strategy.

Why won’t the bank negotiate with me?

Willingness to negotiate varies from one institution to another. Large lenders may be less willing to negotiate because it is often a very bureaucratic process. A decision to declare a default is harder to solve after a default status.

Conclusion

If the bank has not called your loan yet, take action as soon as possible. A decision to move towards a default status has already been made when your loan has been called.

Each lender has different levels of flexibility in how they will handle the process going forward. Your responses can influence their actions and final outcome.

Do not assume that your collateral will be taken and you cannot do anything about it. If the bank believes you have a viable plan to repay or reach a workable settlement, then you may be able to get them to settle or restructure the debt.

You must, however, provide a viable, realistic plan and documentation of how you can get back on track quickly. If you cannot, then planning now on how to handle a possible default status may be your best option.

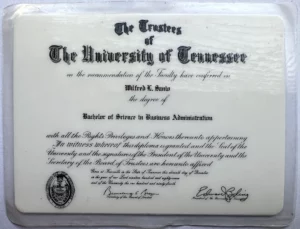

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank in Atlanta, GA. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow