Favored Industries in Business Loans

Businesses in favored industries are preferred by lenders and banks.

They are more likely to get approved and for higher loan amounts.

Check to see if your business is in an industry favored by lenders. If so, these programs will give your company the most funding. Apply below.

Data Secure 15 Second Request Form Here.

Call 919-771-4177 for more info.

FAQ Frequently asked questions on favored industries

What are favored industries?

They are more sought after by lenders and in general as customers for new relationships. In addition, they are usually more stable, consistently profitable and less likely to close their doors.

Are we less likely to get approved for a business loan if we are not considered a favored industry?

Your business may have one less advantage getting approved by not being considered preferred. High risk industries may be restricted and not considered at all.

Will we get more money being as a preferred industry?

Lenders may or may not offer a higher approval amount because of the type of trade you are in. The main factors are still revenues, credit, time in operation, cash flow, and profitability.

Examples:

These include automotive Repair, Dental Practice Loans, Physicians, and Medical Practice loans as well as Beauty Salons, Gift, Novelty, and Souvenir Shops. Additional businesses likely to receive approvals include Restaurants, Electrical Contractors ,Furniture outlets, and Chiropractor practices.

Other examples are Plumbing, HVAC Contractors, Hotels, Sporting Goods, Grocery Stores, Gas Stations, General Merchandise shops, Bars, Nail Salons, General Retailers are also considered preferred. Food and Health Care locations, Clothing outlets, Cleaning Services, and Veterinary Services are also considered more desired businesses to market to.

Business types that are not considered favored may be considered less desirable by lenders and categorized as a restricted industry business loan.

More Examples:

Another group includes Home related businesses, such as Home Health Care Services, Home Furnishing and Hardware.

Optometrists, Automotive Parts and Accessories, as well as Beer, Wine and Liquor, Hardware suppliers, and Jewelry outlets.

Other target include:

Supermarkets, Grocery and Convenience Stores.

Not considered one of these? Contact us above.

Optometry Centers, Glasses and Contacts

Party Supply, Pet Merchandise, Pharmacies, Specialty outlets or Specialty Department locations. Sporting Goods suppliers, Toy, Hobby and Pet Shops.

Barber Shops, Beauty Shops and Beauticians.

Dry Cleaning and Laundry, such as Coin Laundry.

Others include Hair, Nail and Skin Care, and Health Spas are all more Examples of Favored .

Lenders will cater to your business more than other business trades. Another advantage is getting better Terms on Goods and Services.

Learn more about Preferred Trades.

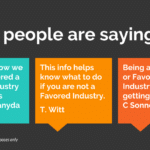

Recent examples from the Web:

Loans to Preferred Industries

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow