How to get a soft pull business loan including for a cash advance.

Interested in using your business’ cash flow overall or company assets to get funding? Watch the video Above:

Definition: What is a soft pull business loan?A soft pull is when personal credit is pulled and checked but does not show as a credit inquiry or lower your credit score.

Apply below for:

High Approval Amounts

Longest Term Soft Pull Programs

Highest number of soft pull programs in the industry

Call 919-771-4177 for more info.

1. Review the website.

See if says credit pulls will be a soft pull or hard pull. If it does not say so review the benefits and requirements.

2. Call the funder.

Ask if it will be a soft credit pull or a hard credit pull for program you like.

3. Pre-review the info.

Some lenders will review your information and can pre-approve you or make a pre-assessment without any credit being pulled. Ask for a pre-application review.

4. Apply.

When it is a soft credit pull and the lenders criteria matches your need, consider applying.

5. Review terms.

If approved, review final terms and conditions. If acceptable, complete transaction.

Need to close a soft pull business loan quickly? Apply now below:

Frequently asked questions FAQ: soft pull business loans

Do you offer soft credit pulls?

Many soft pull options are available. Simply make the request and a representative will review the choices with you.

What is the difference between a hard and soft pull?

Hard credit pulls can lower your credit score slightly in the short term. Credit scores that have gone down from too many inquiries usually recover within three months and are short term. Soft pulls do not affect your score but can still be used to get an approval and funding without any hard pulls.

Are there fewer options with soft pull programs?

Many hard pull programs have better terms and conditions. Rates may also be lower with longer terms and monthly payments. You may be eliminating your business from better approvals by considering only soft pull options.

Can you use a credit report I provide?

You can provide credit reports 30 days old or less. We will give you a free pre-review, after which you can move on to a full review. The analysis using your credit report will be completed before your file goes into underwriting.

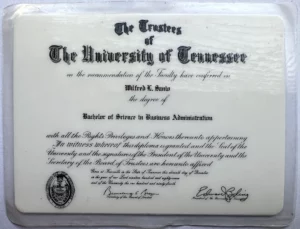

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow