How to Get Money for Product Orders

✅ Step 1: Determine how much total $ amount the business needs to fulfill the order. Don’t underestimate!

✅ Step 2: Contact us to quickly match the approval criteria. If your business meets the criteria, then apply.

✅ Step 3: If approved and terms are acceptable, gather required closing documentation to fund loan.

Get money for product order financing. Apply below now!

Call 919-771-4177 for more info.

FAQ Frequently Asked Questions

What is a product order?

It is an order for goods issued by one company to another. An invoice is issued to the company the order is placed with. It includes a description of the product, number of units, price, model number and delivery date.

How can we get money to finance our product orders?

A percentage of the cost of raw materials and manufacturing for production is financed. The term depends on how long the process takes including delivery to the buyer and payment. Once the process is complete the borrowed funds are to be repaid by the seller. The transaction is often converted to an account receivable and the receivable is used instead as an instrument to repay the debt. In those cases, the buyer pays the cost of the finished product when they pay the invoice.

How do we qualify for product order financing?

Some of the main qualifications include the strength of the company your business is providing product to. How likely they are to pay after they have received product is considered. Also reviewed is whether your company can withstand not being paid for 30 to 60 days after delivering the product. Qualifying for accounts receivables financing helps getting approved for purchase order financing.”

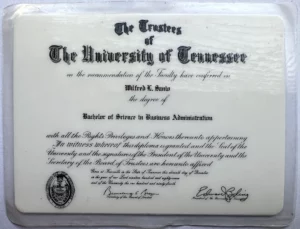

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow