Lower daily mca merchant cash advance payments immediately

Is your account sometimes overdrawn because the mca companies keep debiting the daily payment? Do you have multiple advances and do not know what to do if your daily mca payment is too high? What can you do?

Call 919-771-4177 for more info.

Apply for one of several options below that do not involve settlements, closing your bank account, being declared in default, nor having a cash advance company file a coj certificate of judgement against you. If your payments were temporarily lowered and the cash advance company is restarting the daily payments, consider term extensions or consolidations.

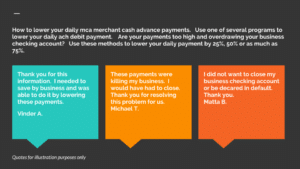

How to lower your daily mca merchant cash advance payments.

1: Negotiate with the mca merchant cash companies to extend the term and lower the payments. Offer to pay a lower amount for a longer amount of time or make changing daily payments based on a percentage of sales.

2: Give the cash advance company solid reasons why you cannot pay the current daily advances.

3: Get an alternative loan or consolidation loan to payoff the advances.

4: Use the equity in assets such as a real estate loan or loan against equipment to payoff the advances.

Data Secure 15 Second Request Form Here.

FAQ, Frequently asked Questions on how to lower daily mca merchant cash advance payments

Can I get a monthly payment loan to pay these off?

Yes. One of the ways to lower your daily mca merchant cash advance payments is to get an alternative loan to pay off the mca cash advances. By doing so, you will be lowering the payment because your monthly payment on the loan to pay off the mca’s will be much lower than the monthly amount you were paying on the daily cash advances.

Usually, you will be paying 50% to 75% less if you are successful in securing a monthly loan to pay the mca’s off.

What if the cash advance companies do not want to lower the payments?

You may have to push hard to get a concession. If your business had a true hardship, such as a hurricane or another type of hardship, make that known. If that fails, read the mca merchant cash advance contract in detail.

Make sure you know exactly what can happen if you do not pay. It may be advisable to seek legal advice through an attorney if you know you cannot repay the advances.

If you know in advance your business will not be able to repay the advances, you can use the time in advance to:

– Determine what your options are

– Know what actions you can legally take

I cannot pay my advance. What can I do?

Check your state laws to find out if your state has special protections and laws. Some laws vary by state. Negotiate with the cash advance company either directly final options may include bankruptcy.

Should I get my Attorney to contact the mca merchant cash advance companies?

Whether you should get an Attorney involved in talking with the cash advance companies varies on a case by case basis. In some cases, having your Attorney contact and negotiate with the cash advance companies is a good idea. If you are offering to work with the merchant cash advance companies and they are not working with you, this may be a good situation in which your attorney contacts them.

Some mca merchant cash advance companies are more willing to work with customers than others. If you do not feel comfortable negotiating or discussing your past due debt with mca merchant advance companies, this may be another reason to involve an Attorney.

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow