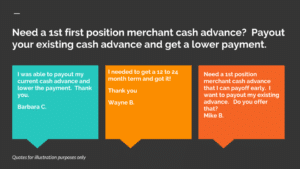

Get a First Position Merchant Cash Advance

Same day funding available. If your business is interested in a 1st position cash advance with low rates available, apply for a bank statement loan option now below: Go to the How to get an MCA Advance Video page here

Call 919-771-4177 for more info.

How to get first 1st first position cash advance:

- Review your funding requirements. Calculate how much you can afford to pay per day or per week.

- Apply with a merchant cash advance company or funder that offers the best products that match your businesses’ cash flow, credit and time in business.

- If your business is approved, review the daily or weekly repayment terms and the merchant contract. If you agree, submit all the required closing documentation and close transaction.

- Receive funds into your business checking account.

Additional funding options

Accounts receivables financing

If a merchant cash advance cannot be obtained, a further option is also accounts receivables financing. When your business has to wait more than 2 weeks to get paid on invoices but needs funding in one or two days, review accounts receivables financing. Get paid about 75% of the face value of the invoice immediately. Once the company you have invoiced pays, get the remainder less a 1% to 4% fee.

Asset based loan

Get funding for your business based on the assets. Assets can be real estate or certain types of equipment. Find out more

FAQ: First position merchant cash advance

What is the highest first position we can get?

The highest amount depends on your most recent three months business cash flow and other debts. Point out when

applying whether you intend to use the funds to payoff other debt. Doing so will allow you to be approved for

a higher amount.

Can you buyout another position?

Buyouts of up to 3 other positions can be offered. Provide an approximate payoff amount for each existing advance when applying and state which other positions you want to buyout.

How long is it for?

Terms are between 2 and 18 months. Discounts are available for early payoff.

What are the rates?

Rates start as low as 1.18. Paying off any existing 1st position advance will give you better terms by having one advance instead of two.

Is credit important?

Credit is not a main factor for approval. The company’s cash flow, consistency of sales and time in business are more important. Higher credit scores will bring lower rates and lower terms.

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow