How to Reverse a Business Loan Decline

There are several ways to reverse a business loan decline into an approval fast. A lot depends on the reasons. Some can be handled in days and you can change a denial into an approval with these easy fixes.

Apply below now for programs such as bank statement loans that specialize in dealing with common decline reasons.

Call 919-771-4177 for more info.

Reverse a Business Loan Decline: 7 common denial reasons

-

- Derogatory Credit

- Debt to Income Ratio too high, or cannot afford new payment

- Insufficient Cash Flow

- Too many recent inquiries

- Ownership percentage not enough

- Unacceptable or no Financial Statements and Tax Returns

- Recent overdrafts or low bank balances

Turn these Denials into Approvals now

1. Derogatory Credit .

Bureau scores that are too low are among the most common declines. Many people believe it takes years to improve their file and that they have to pay a credit repair agency to fix their negative reportings.

Incorrectly Reported Bureau Information:

Many times, information reported by the consumer reporting agency is incorrect. Review your report and look for inaccuracies. You can often get corrections and deletions updated within weeks. Once you have identified the incorrect trade line reports, you can dispute it yourself with the reporting agencies, or hire a credit repair agency.

You will have already done much of the work just by reviewing your file in detail. Doing the rest yourself lets you follow up faster and dispute it again if the reporting agency puts the same slow pay items back on your file.

Outdated Bureau Information

Sometimes outdated information hurts your scores. An old account may still be showing on your report that has been paid. A balance on a current account can be much higher on the bureau than the true balance. Some creditors do not report every month. Disputing or updating outdated trade lines in your file can often increase your bureau scores. Tell investors when you really owe less than what the bureau shows. That improves your ability to pay new debt.

Scores Too Low:

Often, your current scores are too low. Taking the actions above should increase your score because fewer derogatory and outdated items will be on your file. Your bureau scores will jump quickly and may trigger a reverse of a loan decline. Other funders may approve your company with higher scores as well.

2. Debt to Income ratio too high or cannot afford new payment.

Debt to income ratio is the percentage of fixed monthly debt divided by monthly gross income. This is often calculated as part of the credit review process.

For example: A borrower has monthly income of $5,000 and fixed obligations of $2,000. Their d/i ratio is $2,000 % $5,000 = 40%.

If a borrower’s percentage is too high, they may be rejected. Businesses with higher gross sales than others are likely to have more discretionary income with the exact same debt ratio. If you can afford the payment, then document your cash flow. Contact the lender and show them your company’s disposable income figures. Prove that you can make the payment and ask to appeal the denial.

3. Insufficient Cash Flow

Lenders may look at your overall cash flow. Many require a minimum amount of annual company sales to even be considered for financing. Many calculate the maximum loan or mca as a percent of your monthly revenue.

Funding sources that reject for this reason often do so in part on the most recent tax return figures. Your most recent business tax return is already dated. Provide a year to date YTD Profit & Loss statement and Balance Sheet when the current year is stronger than the previous one. Doing so may justify approving a request that originally did not pass the approval process.

If your current year is about the same as the previous, then you would need to figure out other debt or income information that could potentially reverse the denial. For example, large new customers that are new will increase revenues substantially.

4. Too many recent inquiries.

Denials from inquiries can happen if the owner(s) have recently been making purchases that require financing, or new services that require a credit check. Lenders have become more savvy at assessing these, but their automated reviews are not perfect and may not account for inquiries that should not be counted.

Many financing programs use a soft pull instead of a hard pull. However, some programs use a soft pull initially to make an offer but still do a hard pull later before closing.

If a lot of your inquiries are from shopping for consumer goods, or related to living expenses such as utilities, then document these. Contact the funding source and show them what the inquires were for, and they may re-consider their original decision.

5. Ownership percentage not enough.

Applicants must have at least 80% or higher ownership in the company to be able to close most financing on their own. Many lenders require a higher percentage such as 95%, and often full 100% ownership.

Discuss this with the other owners. 100% ownership is required for most financing so they may be required to sign. Your enterprise will eliminate itself from good options if one owner with less than 100% ownership wants to get funding on their own.

There are exceptions for owners with very strong credit and assets. Owners with bureaus over 700 and a strong personal financial statement may be offer a guarantee by themselves with less than 100% ownership. However, many investors will not consider any request with less than 100% of the owners applying, no matter how strong any one owner is.

6. Unacceptable or No Financial Statements or Tax Returns.

Some financing requires financial statements that the applicant does not have and is rejected as a result. This usually includes the most recent 2 to 3 years personal and business tax returns, current interim financial statements and bank statement payback months for the same repayment months the new financing will be for.

Gather and provide the missing items and request your application to be reconsidered.

In other cases, financial statements were not acceptable. This normally means the gross or net income was not high enough, or not enough the cover the new payment. A decline may result from just having one lower sales year out of the last three. They want to see steady or increasing business revenues annually or they will not approve the request.

Alternative Options: Look for other programs if this is required.

7. Recent Low Bank Balances or Overdrafts.

Even with a strong company and personal profile, recent low bank balances or overdrafts may be a source of rejection.

Your may need the cash because of a recent slow sales. Many lenders are not forgiving to recent slow cash flow and overdrafts. Applicants believe recent low sales is why they should be approved for funding. Funding sources believe low sales in the last quarter is why a borrower wont’ be able to pay and therefore don’t make the offer.

Alternative Option: Look for another lending program, or wait 30 to 60 days for your cash flow to rebound some, then apply. If you can wait, first ask if it will make a difference. Consider other sources when your request will not be reviewed again later.

Discuss your recent cash flow or overdraft issues in depth with the lender that rejected your business. They will tell you they will reconsider it, but are very unlikely to change their original decision to an approval. Many investors must consider all requests, whenever made. Talk to them about fixes to previous issues before re-applying.

FAQ: Frequently asked Questions on how to reverse a business loan decline fast:

How can a decline be reversed?

The reasons can very often be quickly corrected or improved by making relatively easy updates or changes, such as ownership percentage. Ask the lender if the changes you make may cause them to change their decision before you re-apply.

Can the decision be overturned into an approval fast?

Many changes can be made within days that allow a lender to reconsider the request. Other changes will take longer but may still be accomplished within 30 or 60 days.

What if I can’t wait?

If you do not have the time to make corrections, then the best approach is to consider another type of funding that will not give you the same negative result. Talk to other lenders in advance before applying.

Conclusion: Change a business loan decline into an approval

Do not believe that nothing can be done after your business does not get an offer. Reverse a business loan decline into an approval today. Having documentation, a strong rationale and persistence are key to turning a no into a yes.

Sometimes the wait may be weeks, but the result can be reversed in the end.

You will understanding what can be corrected and this is information to use in your favor to get the funding needed!

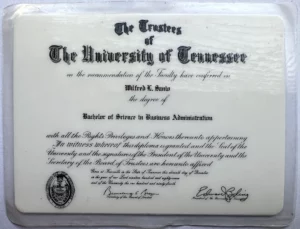

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow