Too many Overdrafts and NSFs

One of the reasons companies are declined for business loans is for too many overdrafts and NSFs. They have excessive Overdrafts and NSF’s per month maybe due to low sales and deposits, especially under $10,000 a month in deposits. It is also # 6 of the Top 9 Reasons why MCA’s are declined.

Author Biography: Will Sanio

What are non sufficient funds and overdrafts? A overdraft or insufficient funds is a negative balance in a bank account caused by drawing more money than the account holds in part because of low deposit volume.

Call 919-771-4177 for more info.

Data Secure 15 Second Request Form Here.

How can your business overcome being declined for a business loan or Merchant Cash Advance for having excessive Overdrafts or excessive NSFs? Here are several tips that your business can follow to get a business loan.

You will get you the best program for your business. Don’t forget to be ready for the business checking account verification.Apply below today.

Business account overdrawn.

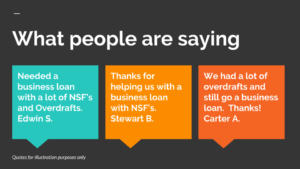

We assist businesses in overcoming these obstacles so they can focus on making their business prosper.

Many times a business loan that is approved falls through at the last minute and does not close if there are overdrafts and NSF’s before closing. If there are too many overdrafts and NSF’s since the beginning of the Month, or between the time of approval and closing, it may be declined just before closing. When a Bank verification is done and the Account is overdrawn, the loan may then not close and be declined.

At the time you are trying to close a loan with an overdrawn business account, make a deposit immediately before the Lender checks the bank account. If you make a deposit beforehand, you can save the approval. If it is too late and the loan is declined, ask the Lender if you can make a deposit to bring the account into the positive will they close the Loan then? Do not try to close a loan if your account is overdrawn. Wait until it is in the positive.

FAQ Too many overdrafts and nsfs

Can we get a business loan with nsfs and overdrafts?

Approvals are issued everyday to businesses with nsfs and overdrafts in their checking account. Having enough cash flow to pay the debt and only having overdrafts occasionally helps. Provide a good explanation for why the account was overdrawn when applying.

How hard will overdrafts and nfs make it to get a business loan?

Overdrafts and nfs do not always keep your business from getting approved. You may get approved for a lower amount with higher rates and shorter terms. Overdrafts in your business checking account in the last 30 days are more important, and the last 90 days are usually looked at. Rules on the maximum vary from lender to lender.

How many overdrafts and nsfs can we have?

Most business loans limit overdrafts and insufficient fund items to about 5 per month. Ask specifically for any business financing you may apply for. Some programs will not allow more than 3 recent overdrafts in the last 30 days.

Why were we declined for paid nsfs?

The lender probably declined because they felt the cash flow and average balances were not strong enough. Even when insufficient fund items are paid, they still happened and the lender may believe any new debt will be too much.

How to get approved with excessive Overdrafts or NSF’s

Talk to lenders in advance and find out if the lender has a maximum number of Overdrafts or NSF’s per month they accept. We can put your business into qualifying programs so your business can get all the Capital it needs.

Other options if declined

Too many Overdrafts or NSF’s for an MCA merchant cash advance or ACH bank loan.

Talk to the Merchant Cash Advance companies and ACH business loan lenders directly about being declined for having too many Overdrafts or NSF’s per month. Ask them if there are other programs available you may qualify for right now. Always ask if you can start out for a lower amount.

In addition, make sure your business does not have any more Overdrafts or NSF’s for a few weeks and apply at the start of the next statement month.

Possible solution:

If you know you will not have any more Overdrafts or NSF’s the next few weeks in your business checking account, tell the Merchant Cash Advance company or ACH business loan company. If the overdrafts or NSF’s were from a single event instead of spread out throughout the months, this can make a difference. It is an isolated incident. Let the lender know they resulted from a one time event. Many decisions are automated and made quickly. Make a strong case and the lender may reconsider your request.

If the lender will still not approve it, ask how long you have to wait before your can be reconsidered. Ask what needs to be corrected to avoid being declined again.

Get other working capital loans

Your business can apply for other types of business loans if time is critical. Which ones are best depend on your company’s financing needs and situation. Choices include:

Also consider business loans based on Real Estate, Equipment Assets

that are free and clear, and Account Receivables. Monthly Term loans up to 60 months or longer with full financials.

Your business can overcome being declined for a MCA Merchant Cash Advance or ACH business loan for having too many Overdrafts and NSF’s. The SBA small business administration offers advice and workshops on business loans.

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow