Has your business been declined for not having enough collateral?

Then choose from a small business loan that has 5 very flexible no collateral options. Click on the Info Form below because fast as same day funding is just a click away.

You may still able to negotiate. Lenders often want too much collateral and borrowers do not push back. Sometimes lenders won’t accept high value vehicles because they need repair. Use a truck repair loan to get broken down assets in operation again and qualify as acceptable collateral.

Call 919-771-4177 for more info.

Business funding does not have to be hard to get. Does your business have collateral or cash flow? If so, there is a program that will fund your business. Requests for higher amounts are much more likely to be declined for the applicant not having enough collateral. Denied for not enough collateral? See Tips, FAQ questions and answers below.

Frequently asked questions FAQ declined for a business loan for insufficient collateral.

What does insufficient collateral mean?

You or your business did not have the assets that lender wanted to approve a loan. We specialize in funding business loans against collateral large and small using many asset types and with the toughest credit a borrower can have.

What can be used as collateral for a secured loan?

We can use equipment, vehicles, semi-trucks, trailers, and real estate for hassle free and quick funding.

What if I don’t have collateral?

A cash flow or unsecured loan can be approved. Pre-qualify immediately and get an approval and funding within hours in many cases.

Why do some loan companies want collateral?

To approve a business loan instead of declining it. The lender can sell the collateral if a borrower defaults and recover what is owed to them. This lets them make more and higher offers.

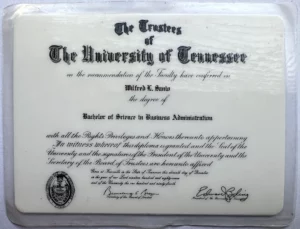

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow