Landlord contact information: What is it?

Landlord Contact information is the Name, address and Telephone number of a person or business’s Landlord. It is used to verify personal residence or a business address.

To get a business loan without providing this info, contact us below for other options.

Data Secure 15 Second Request Form Here.

Call 919-771-4177 for more info.

Examples of Landlord Contact Information:

A business owner applies for a business loan and is approved. One of the closing stipulations may be giving landlord contact Information so the lender can get a landlord waiver. Consider other types of business loans that do not require it.

Did you know?

Customers do not always have this contact information. What to you do if you are a home based business and are being asked for this information? What if you are also the owner of the property and it is paid off?

Let the person requesting this information know you own the property and also if it is paid off. If you are home based, let them know this. Being home based is often acceptable and you will instead be asked for other information to satisfy this requirement.

This information is requested for many reasons. Most often when someone is requesting a product or service, and also entering into a Contract.

Requests and statements by callers below include:

Why am I being asked for this information and what

should I provide?

Ask why the information is being required and provide if the request is reasonable. Sometimes a Lender will try to call the Landlord as part of a personal loan or business loan request. Ask the Lender if they will call your Landlord. If so, give your Landlord a heads up to expect a verification call.

Learn more about Landlord Contact information.

Recent examples from the Web:

Types of Emergency contact requests:

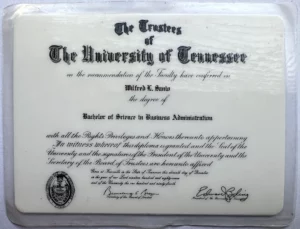

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow