One Month’s Bank Statement MCA’s

For New businesses and More!

MCA option available with as little as one month’s bank statement and some funding options with

less than 3 months time in business. Restriction Apply, ask us how!

Complete the one page application below & provide the first month’s business bank statement. This is a start up specialty bank statement loan program for new businesses OR businesses that recently started generating revenue. Visit our homepage for more programs. To visit the stand along video page for this video, go to

how to get an mca with less than 3 months bank statements.

Call 919-771-4177 for more info.

1.As litttle as 1 Month’s bank statement required.

2.New Businesses.

3. Businesses that have been using a Personal

Checking Account for their business and just recently opened a Business Account.

Apply above:

New Business: Loan program

New businesses can get approved with just the most recent month’s statement and the fast 15 second application. Don’t forget to be ready for the business checking account verification. Renew the loan and increase the approval amount as your sales increase.

A short time in business is also #8 of the Top 9 reasons why your MCA was declined.

This program is excellent for

New Businesses.

Companies that expect to have big swings in business revenue

Businesses that want to establish a relationship with a lender.

With this program, all the most recent 3 or 4 months bank statements may not be required.

Typical Existing Programs

Almost all current programs require the most recent three months bank statements and a month to date statement.

Why? Underwriting wants to see how the company’s cash flow has been over the most recent months. They take the average of those 3 months and issue an approval based on the average.

Example: A business provides statements for the last 90 days and has the following total deposits during that time.

July: $10,000

June: $15,000

May: $10,000

The average per month is calculated as follows:

$35,000 % 3 = $11,666 per month. In this example, the lender can make an offer knowing that the business brings in an average of $11,666 month.

Lenders cannot calculate an average with only the numbers for the last 30 days. If the business deposited $10,000 in July, then the lender will make an offer based just on that 30 day total.

An offer may be slightly lower, but the business has the opportunity to get a higher renewal offer quickly. As sales increase, the business can get a much higher renewal offer.

Data Secure 15 Second Request Form here.

Call 919-771-4177 for more info.

MCA Cash Advance: Less than 3 Months Bank Statements (Video Transcript: Click to Expand)

Qualify and be eligible for funding. You’ll find what you need here. To apply click on the apply button at the bottom right of this screen, or

On the end screen of this video. Or Call us at 919-771-4177 or go to smallbusinessloansdepot.com.

Eligibility

This is a unique option to help new businesses. It’s also for companies that have been running their business revenue through their personal checking account because they never opened an account in the name of the company when they started. We have even just added more funding options for these types of qualifying Businesses. We heard you loud and clear and we are delivering. Some Conditions and restrictions apply. Apply now or call us. Businesses are almost always turned down flat if they don’t have those 3 or 4 months business bank statements. But what if I don’t qualify for this option you ask? We have several Options to qualify just about all businesses.

Program Options

From Unsecured Cash Flow Loans like Bank Statement Loans, Business LOC style options, Asset Based Loans on your Equipment, Trucks, Big Rigs, Construction Equipment, and how to get a large Business Loan Through smallbusinessloansdepot.com. Click on the apply button at the bottom right of this screen. Weekly, bi-weekly, daily, or Monthly payments options are available, depending on the program. There are specialty low rate programs for preferred industries like Retail, restaurant, auto repair, beauty supply and spa, medical, Dental, and Chiropractors. Is your business in an industry that is restricted and cannot easily get funding? Find Out what options are available for your business. used car dealers, Real Estate, Trucking Companies, collection agencies, non profits, Attorneys, religious organizations and many other hard to fund type of businesses That have trouble finding options. Get a business loan when the owner, has a Misdemeanor or felony conviction on your background record. How to get an mca cash advance. What are the Qualifications for example, to get your first cash advance. Calculating affordability: Can I afford the payments? What to do if you need more money. Should I get a 2nd or even a 3rd Cash Advance? There are ways to get more money through your existing advance that are better than getting multiple advances from different companies. Articles on getting the lowest rate MCA if you need a longer term than the Standard 6 to 9 months on cash advances. And when it’s time for a renewal, get the lowest rate on your renewal.

Alternative

Several Articles are dedicated to how to get an Alternative to a Cash Advance. Also learn what some states like California, Virginia, Florida, Utah, New York and others require for bank statements and the disclosures involved. Solutions for closing requirements that you cannot meet that often cause last minute declines just Before closing. How to pass a bank verification such as DecisionLogic that is required before your business is funded. Find articles on specialty business loans to repair your Truck, against your truck Or vehicles, or against your trailer. Have you ever been asked for an MTD Month to Date statement? We show you how to get it Step by Step and also avoid being declined For problems with your current month such a drop in deposits Since the beginning of the month. Are you afraid you will be declined and not want to apply? Maybe because your credit score is too low or other reasons? Find out in advance the top 9 reasons why Business Loans are declined and what Business loans you can get approved For and close with a low score and other problems. Emergency business money for Payroll and Product Orders. Is your business is a new start up and you do not have 3 months Statements or time in business? Read about the options. Many businesses have low or declining monthly deposits and low Average balances. Find out where and how your business can get Funding with these issues.

Apply

To apply, click on the apply button at the bottom right of this screen, Or on the end screen of this video, or call us at 919-771-4177 or go To smallbusinessloansdepot.com. On YouTube, please subscribe, like and Share.

FAQ on business loans with only 1 months bank statement.

Can we get a loan with just 1 month’s bank statement?

Yes. You only need to provide the first month’s statement as a brand new business. Businesses that had a strong month since the 1st of the current month can provide a month to date statement to get a higher offer.

What if our first month had low sales?

You may still be able to get a starter offer. As your sales grow, you will be offered higher amounts quickly. This is a relationship product that your business can use like a Line of Credit.

Can we get approved with only a few weeks in business?

You only need 4 weeks or more in business. If the business began the previous month, then provide information since the beginning of the new month. This can be a MTD Month to Date statement.

Conclusion

New businesses have limited or no funding options. This new program allows them to get capital after only 1 month.

Even better, a relationship is established with the lender. The borrower can get more working capital sooner and for larger amounts as the relationship is developed.

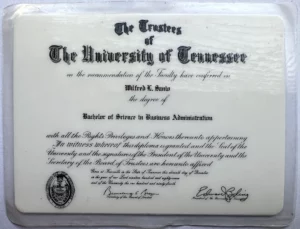

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow