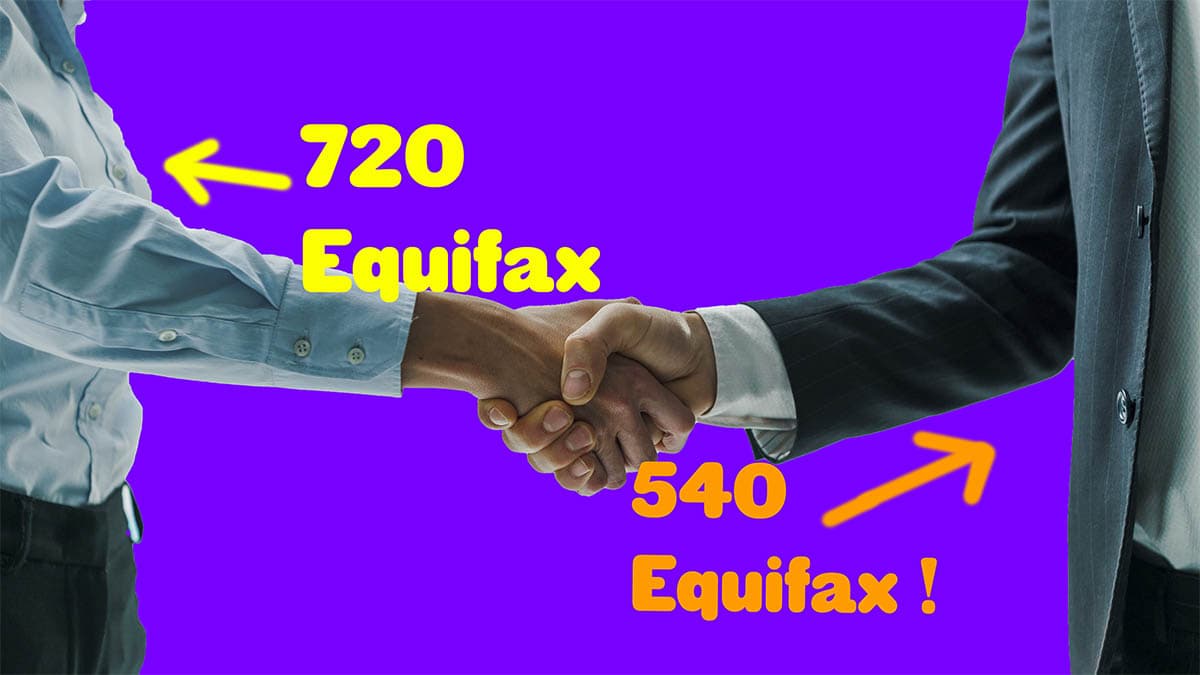

Have a business partner with bad credit?

Pick from several loan options when you have a business partner with damaged credit. That partner can even be you!

An associate with a low credit score will cause challenges.

4 fast fixes below are designed for EXACTLY these situations.

Data Secure 15 Second Request Form Here.

Call 919-771-4177 for more info.

Apply above now and get business funding today with business owners that have low credit scores.

Temporary Options and Solutions:

1. Good Credit Owner: Applicant #1

The stronger credit owner should always be the first applicant on any request.

Never list the bad credit owner first. A strong credit owner may be enough to carry an approval and cause the lender not to reject for remaining bad credit.

2. Change in Ownership Percentage

The most impact that can be made fast is lowering the ratio of ownership of the partner with bad credit. They may not agree to this. However, lowering it to less than 20% should prevent declines and less than 10% would be even safer.

This will not be popular with many owners. Companies can consider options including a remix of company stock ownership.

Higher salaries and a commission structure can be increased. Another compensation is to pay more towards IRA’s, Pensions and Savings plans. The change can be temporary.

3. Change Articles of Incorporation

If the partner with hurt credit agrees to lowering their stakeholder amount, the Articles of Incorporation should be changed to reflect this. Many States show ownership breakdown in the Articles of Incorporation.

4. Updating the Secretary of State

Update the Secretary of State listing which lists information on the company. Remove the owner with bad credit, or their lower percentage. List the owner with better file as the main owner.

FAQ Frequently asked questions on getting a business loan with a partner with bad credit

Question: Can we get a loan if my business partner has bad credit?

Answer: Search for lenders that offer programs specifically for business partners with bad personal credit and low bureau scores. Ask about approval requirements in advance, including a minimum credit score.

Question: What can we do after being denied a business loan for my partner’s low credit scores?

Answer: One option is to lower their ownership percentage at the secretary of state to below 20%. Some lenders won’t require them on the application or decline for derogatory trade lines if their shareholder percentage is very low. Another option is to remove them entirely as owner of the business.

Question: Should we try to fix my business partner’s credit instead of taking them off the business altogether?

Answer: Work on improving the bureau first if there is enough time. They can be lowered to 5% ownership or less and avoid being reviewed by many lenders.

How a bad credit partner negatively affects a business

Getting approved with a low credit score partner.

Options are more limited when applying for financing with a partner that has derogatory personal credit. Lenders may decline when the ownership split goes over 20%

Some funders will not pull a bureau if the shareholder percentage is less that 20%. If the percentage is less than 5% or 10%, more lenders will not look at the information of those owners. If the business partner with a derogatory file has close to 50% interest, then chances are much higher the request will be declined. This is especially true with more traditional lenders like banks and the SBA.

Once the company has taken care of the financing needed, the owners can consider longer term programs for derogatory history. Should an owner with bad credit fix it or wait it out?

Getting a business location

Renting a location

Once a commercial location is found, the company owner’s credit is looked at. Landlords will pull a bureau.

Damaged credit may cause a rental request denial. Discuss this with the landlord. If the other owner has a very good file, the landlord may approve the rental request and lease the property.

Buying a location

If your company wants to finance the purchase of a location through a commercial mortgage, the lenders will also look at all the owner’s credit. The level of scrutiny will be higher than with a rental request, including full financial information.

Establishing business trade accounts

Many companies establish trade accounts. Companies check the business and personal credit of the main owners when a trade account is applied for. Significant negatives in the file may be a reason for denial. Not being able to secure important trade accounts can be very damaging and cause the business to be short of the inventory, equipment and other critical needs.

Even if the business can secure the trade accounts it needs, the terms may be more expensive because of the partner with bad history. This will translate to increased costs to operate.

Obtaining Government and Private contracts

When a business bids on private or government contracts, the personal credit of the owners is reviewed. If there is a business owner with a severely damaged bureau, it will be more difficult to secure these contracts. The contract request may even be denied for this reason.

Background checks

There are many reasons why a background check for a business loan may be completed on the owners. Some of the reasons have already been listed. If a background check is requested, it will include a bureau. Bad trade account history on any of the owners may be a reason for denial in a background check.

If further assistance is needed, the SBA has excellent resources.