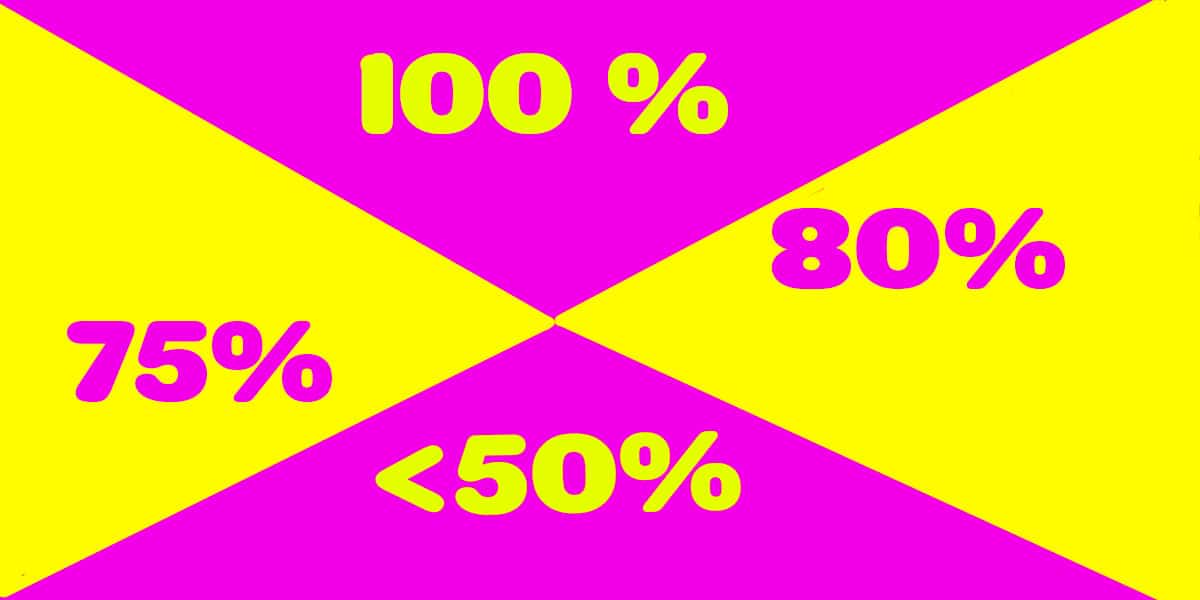

Business Ownership Percentage for Loans

Having the right Business ownership percentage is very important for obtaining small business loans. If one person has less than 80%, they usually cannot close the loan by themselves. Many lenders want 100%.

Apply below for programs that allow less than 100% to complete funding.

Data Secure 30 Second Application here.

Call 919-771-4177 for more info.

100% Business ownership NOT required for financing.

- 100% is not needed.

- Shareholders as low as 25% for some bank statement loan programs. Most options require at least 51% to 81%.

- 1 Owner can sign in many cases.

- Remaining shareholders do not need to sign for some programs.

Top 7 Benefits:

1. Financing programs that fund with less than 100% ownership.

Get approved and also be able to close the loan with less than all the owners applying and signing on the note.

2. 1 owner may be able to close by themselves.

Another benefit is the other owners do not need to sign. Therefore, you don’t have to negotiate with them and convince them to sign on the loan.

3. 1 Shareholder may be able to make decisions.

You can make the decisions on the company loan even though you are only one of the shareholders for some options. Decide how much to borrow, for how long and any other options offered by the lender.

4. The other partners do not provide a personal guarantee.

The personal assets of the non signing partners are protected. Many are not spouses or family members and their assets are separate when applying.

The personal assets of other shareholders will not be at risk under the loan, which is significant. Others often hold Real Estate and other assets separately.

Call 919-771-4177 for more info.

Related Business Ownership percentage issues

Decision making.

When there are several owners with similar shareholder percentages, it is difficult to complete many basic transactions such as sales with vendors, contracts and contract changes.

Shareholder percent of assets.

Assets that are in the company name are owned by all of the owners.

There is excellent business financing against vehicles with monthly payments. Carefully review how shareholders are specifically listed on all assets, including on titles for loans against vehicles.

Selling, negotiating, or transferring joint business assets

Assets in the company name with multiple owners must have the approval of all of them for any changes. Everyone must agree and sign for the sale, transfer and any loan against an asset.

Anyone excluded from the sale invalidates that sale.

Selling with multiple owners.

All must approve and sign any sales contract when the company is sold. One party cannot sell it alone.

Ownership control of Checking and savings accounts

Checking, savings and other commercial accounts can be opened without all owners. Authorized signer information is keep on file by financial institutions.

One signer also cannot remove another signer from the account. Other signers must agree to their own removal. If one owner wants to be on an account alone, they can open a business checking account with themselves as the only signer.

They should check what the banks’ rules are for making changes. Changes such as closing an account, withdrawing money are difficult later without specific documentation.

Changing stakeholder percentage.

Update the articles of incorporation or organization to increase or decrease these sipercentages. The articles may vary by state.

Many times, corporate articles do not list share percentages. Most articles list principals such as President, Vice president, CEO and officers. The lender does not have the breakdown.

A big reason businesses fail is disputes between owners, including who has the authority to make decisions and complete transactions. Including specific percentages and shares owned eliminates many future disputes. New corporations should include this information in their paperwork.

Use addendums and corporate change paperwork to add this information. Another option is to add a notarized corporate change resolution or additional information page. File these with the Secretary of State.

FAQ: Frequently asked Questions:

Do I need 100% ownership to get a business loan?

100% is not always needed to get a small business financing. Programs are available with percent ownership below 80% and as low as 25 in some cases.%.

Does my business partner have to sign if they don’t want to?

Partners do not have to sign when one has enough ownership. Ask the lender what is required for closing.

Can I remove my partner from the business to get a loan?

No, and you cannot remove your partner without their approval in general. Lenders do not want quick changes just to get the funding. Get approval from the funding source first before attempting this.

Conclusion: Business loans closed with one signer has major advantages

As described, one company shareholder with the authority to close a loan has many advantages. They can make all the decisions on their own. They do not have to discuss and get agreement from others, which is often a major hurdle. This includes financing and applying for working capital loans.

Choose financing that funds and closes with one owner. Find out the requirements from the lender and make changes to your company profile for insufficient shareholder percentage, if needed.

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow