How to get an MCA with less than $10,000 per month in Deposits

Apply below or Call 919-771-4177

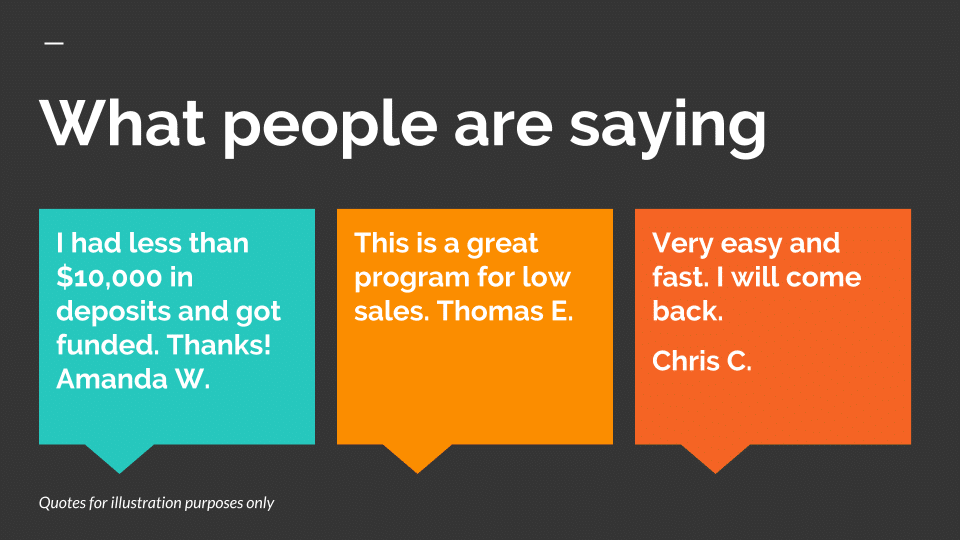

Has your business been declined for having less than $10000 in deposits per month? Most lenders will decline companies that have monthly sales below this amount. New bank statement loan programs for sales as low as $4,000 per month, including one program using business vehicles. Go to the Video only page

less than $10,000 per month in deposits.

Apply below now to get specialty program funding for your business if you have low sales or other top decline reasons. !

Data Secure 15 Second Request Form Here.

Call 919-771-4177 for more info.

Get an MCA with under 10,000 a Month in Deposits (Video Transcript: Click to Expand)

We have options. If you have less than 10000 per month in Sales, your business may qualify and be eligible for funding. You’ll find what you need here. To apply click on the apply button at the bottom right of this screen, or on the end screen of this video. Or call us at 919-771-4177 or go to smallbusinessloansdepot.com.

Eligibility

These are programs that help businesses with low sales and new businesses. It’s also for companies that need more options or alternatives for funding because their sales are not high enough. We have just added more funding options for your type of business. Some Conditions and restrictions apply. Apply now or call us. Businesses are almost always turned down if they do not have at least the minimum monthly sales. Also, the $10000 per month you hear about is business revenue. Transfers, refunds, deposits from other loans or anything besides business revenue does not count and will be deducted from your monthly sales. Do you have transfers from other business accounts? None of your accounts have enough deposits per month to get you approved or approved for as much as you need?

TIP:

Send the most recent statements from these other accounts also and the revenue from those other accounts you are transferring from, may be counted. PayPal statements do not qualify. If you are running your business revenue through PayPal, even a business PayPal revenue account, it will not be counted as revenue for business funding. Open a business checking account and start running your money and deposits through that account. Don’t qualify for any cash flow funding options? We have several other choices.

Alternatives:

. They include money against your equipment or Vehicles. Another good option is getting money now against your accounts receivables. This is excellent for newer businesses that need cash in early stages. If your deposit totals are less than $5,000 per month in one of the last several months, that is not necessarily a decline. If one of the other months is higher, the average may be accepted.

Apply

click on the apply button at the bottom right of this screen, or on the end screen of this video, or call us at 919-771-4177 or go to smallbusinessloansdepot.com.

FAQ’s on getting a businesses loan with less than $10000 per month in deposits

Can we qualify with less than $10,000 per month in deposits?

Yes, you can qualify for business funding with less than $10000 a month in deposits. You can get approved on an average of your monthly deposits.

What is the lowest amount in deposits we can have per month?

For business funding using cash flow, your business should have at least $5,000 per month in deposits from business revenue.

Are there other options if we had a month below the minimum?

There are several asset based business loan options that do not require a minimum amount of deposits per month. Options with high credit scores are also available.

We have outstanding programs for companies with low deposit volume of less than $7,500 per month. Companies may also qualify for a weekly or monthly payment.

Data Secure 15 Second Request Form Here.

Call 919-771-4177 for more info.

Funding Example with Monthly Payments:

# 1: A Monthly Payment for 9 and 12 Months:

Mildred’s day care deposits $8,000 per month. She was declined by other funders for being below $10000 per month in deposits and her average daily balances too low.

How much can she qualify for Monthly?

She qualifies for 20% of her monthly deposits to be paid towards a loan. $8,000 times .20 = $1,600.

For a monthly repayment loan over 9 months, then her payment is:

$205.50 per month for months. This is based on a total repayment of

$1,850. $1,850 % 9 = $205.50 per month.

For a monthly repayment loan over 12 months, then her payment is:

$158.33 per month for 12 months. This is based on a total repayment of $1,900. $1,900 % 12 = $158 per month.

Funding Example with a Daily Payment

#2: A Daily Payment for 9 and 12 Months:

How much can she qualify for daily?

Using Mildred’s Day Care again but calculating a daily payment for the same 9 and 12 month example.

For a daily repayment loan over 9 months, then her payment is:

$10 per business day for 9 months. This is based on a total repayment of

$1,850. $1,850 % 9 = $205.50 per month. $205.50 per month % 21 days = $10 per business day based on 21 payment days every month.

For a daily repayment loan over 12 months, then her payment is:

$7.52 per business day for 12 months. This based on a total repayment of

$1,900. $1,900 % 12 = $158 per month. $158 per month % 21 days = $7.52 per business day based on 21 payment days every month.

These are low payments designed so that business owners can make the payments, repay the funding and borrow again as soon as they have a need.

Other Benefits:

50% pay down rule.: Borrowers making timely payments can borrow again as soon as the total balance is 50% paid down or more. They provide their most recent 3 months statements and if sales have remained the same or increased they can be funded again or increased.

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow