Customer Complaints with Business Loans: Top 12

Customers have several common complaints about Business Loans. Here, we will take a look at the Top 12 customer complaints. Customers often do not close an approved business loan because of one or more of these reasons. Apply below for programs that fund businesses over these hurdles!

Data Secure 15 Second Request Form Here.

Call 919-771-4177 for more info.

Top 12 customer complaints with business loans:

-

- The rates and cost is too high. They want a better rate and terms.

Customers often want and need a business loan with a lower rate and better terms.

Another requirement is they need working capital with lower total repayment and lower cost overall. - The approval amount is not enough

Customers often call in and say they need a higher approval amount and more money

for my business loan. They will go for a different loan if they cannot get what they want, or also get a second loan. - The term of the loan is not good.

Customers also say the term is too short and needs to be longer. Another requirement is a business loan longer than 24 months. - It is not a Monthly Payment.

A very frequent request is to get a business loan with a Monthly payment. Customers really want a Monthly payment if they can get it. - It is a daily payment.

Applicants will say right away if they do not want a business loan with a daily payment. Many have had this type of repayment in the past and will not do it again. - It is a Merchant Cash Advance.

Customers oftentimes do not want a Merchant Cash Advance. They will say they need a business loan that is not a Merchant Cash Advance. When this is the case, the customer will look for alternatives to a Merchant Cash Advance. - The Prepayment option is not good.

Another complaint is they want a business loan with no prepayment penalty. They want to be sure they will get a good discount if they pay off early. - The type of loan is not what they wanted.

Sometimes customers will tell you they don’t want the type of loan they have been approved for. They do not want very expensive payments or an unfamiliar product.They are not sure what type they want, but they have decided they don’t want the one being offered. Have a conversation about other business loan types so Customers will get the loan that works for them. - They don’t want to put up Collateral

Many do not need or want a business loan with Collateral. They do not want to put up Collateral, or they do not have Collateral. - Do not want to give a Personal Guarantee.

Customers may not want to close a business loan with a Personal Guarantee. They believe they can get an offer without one but most financing requires it. - Whether the loan will, or will not be reported on their Personal Credit.

A business loan that reports on Personal Credit is sometimes specifically requested. Other times, customers want the opposite and do not want it reported to the credit bureau. - The request took too long.

Some requests that are eventually approved do not close because the processing time was too long. Customers will tell us they need funding quickly. These are the Top 12 Customer complaints with business loans. Contact us to apply for programs that avoid these problems.

- The rates and cost is too high. They want a better rate and terms.

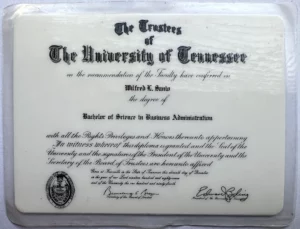

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow