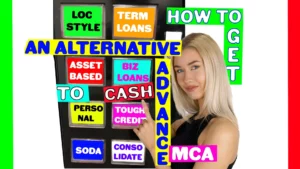

Get Alternatives to an MCA Cash Advance

Get alternatives to a Cash Advance MCA, such as large business loans, a loan against equipment or loan on a truck or vehicle. Go here for just the alternative loans video page. A similar transaction is a Sale Leaseback. To watch the video visit

Sale leaseback on equipment Video or go to full instruction

page, Sale leaseback on Equipment.

Author Biography: Will Sanio

Call 919-771-4177 for more info.

Apply above or call us for excellent alternatives to a high daily and weekly repayment. Visit our homepage for or small business loans Video page for features on different loan types. for a regular cash advance, go to the: How to get an MCA Cash Advance page.

How to get an alternative to a Cash Advance MCA

Supply: list of business equipment assets. Include manufacturer, model and serial numbers and year of asset if applicable

Tool: Desktop, laptop, tablet or phone

Step 1: Look at alternative options.

Will Sanio, SmallBusinessLoansDepot.com. Today’s video: How to get an alternative to a cash advance mca. Start the process anytime by tapping apply apply on the bottom right of this screen, or tapping on the end screen of the video, or on the apply button on the webpage.

Look at alternative options that include a line of credit style or term loans, asset based, government spa, and larger personal loans. Line of credit style and term loan options offer a weekly, bi-weekly or monthly payment.

Asset based alternatives are offered if your company has free and clear equipment, vehicles, or accounts receivables that do not have liens or money owed on them.

Your total annual business revenue, monthly deposits, average daily balances, overdrafts and nsf’s do matter. Make sure these look good in the weeks or months before applying for funding.

TIP: Personal loans for higher amounts, up to $50,000 and more are another option. These look mostly at income, background and credit score.

TIP: Your total annual business revenue, monthly deposits, average daily balances, overdrafts and nsf’s do matter. Make sure these look good in the weeks or months before applying for funding.

VIDEO CLIP below: Look at alternative options: 16 Seconds – 56 Seconds in Clip below.

Step 2: Get information needed to apply.

For asset based equipment requests, make a list of your equipment, including the make of your equipment. For Example: John Deere, Caterpillar, Kubota. Then add the year, model number and hours. For vehicles, include the mileage. Find copies of titles for all vehicles and take at least 1 or 2 good pictures.

For accounts receivables, make an aging schedule. This is just the name and contact information of the company paying, the amount owed to your company, and the date you issued the invoice.

VIDEO CLIP below: Get information needed to apply: 56 Seconds – 83 Seconds in Clip below.

Step 3: Match with a Lender.

Match with a lender that fits the alternative to cash advance mca options your business should qualify for.

TIP: Talking with a representative before applying usually can pre-qualify your business for specific programs.

VIDEO CLIP below: Find a Lender Match: 83 Seconds –94 Seconds in Clip below.

Step 4: Apply.

Next, Apply.

TIP: Proof of business income, ownership, and address may be required. This means business bank statements or business license to prove your business exists legally, and who all the owners are.

TIP: If the request or approval amount is high, up to $100,000 or higher, more items may be requested, such as a tax return or financial statements.

VIDEO CLIP below: Apply: 94 Seconds – 116 Seconds in Clip below.

Step 5: Close.

Close the transaction.

TIP: For asset based loans, including equipment or vehicles, a site inspection and pictures or video of the collateral may be required. GPS installation on the equipment is usually a condition of funding vehicles such as trucks and also construction equipment.

After reviewing the contracts, if you’re satisfied, complete them. Funding usually takes place within 24 hours by wire transfer or act deposit.

VIDEO CLIP below: Close: 116 Seconds –140 Seconds in Clip below.

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank, in Atlanta, Georgia. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow

Show Video Transcript

In minutes and seconds. 0:16 look at alternative options 0:56 gather all documents 1:23 find a lender match 1:34 Apply 1:56 Close

[ city street sounds ][ introduction sound effect ] Will Sanio, SmallBusinessLoansDepot.com. Today’s video: How to get an alternative to a cash advance mca. Start the process anytime by tapping apply on the bottom right of this screen, or tapping on the end screen of the video, or on the apply button on the webpage.

Look at alternative options that include a line of credit style or term loans, asset based, government spa, and larger personal loans. Line of credit style and term loan options offer a weekly, bi-weekly or monthly payment.

Asset based alternatives are offered if your company has free and clear equipment, vehicles, or accounts receivables that do not have liens or money owed on them. Personal loans for higher amounts, up to $50,000 and more are another option. These look mostly at income, background and credit score. Your total annual business revenue, monthly deposits, average daily balances, overdrafts and nsf’s do matter. Make sure these look good in the weeks or months before applying for funding.

For asset based equipment requests, make a list of your equipment, including the make of your equipment. For Example: John Deere, Caterpillar, Kubota. Then add the year, model number and hours. For vehicles, include the mileage. Find copies of titles for all vehicles and take at least 1 or 2 good pictures. For accounts receivables, make an aging schedule. This is just the name and contact information of the company paying, the amount owed to your company, and the date you issued the invoice.

Match with a lender that fits the alternative to cash advance mca options your business should qualify for. Talking with a representative before applying usually can pre-qualify your business for specific programs.

Next, Apply. If approved, request the closing docs. Proof of business income, ownership, and address may be required. This means business bank statements or business license to prove your business exists legally, and who all the owners are. If the request or approval amount is high, up to $100,000 or higher, more items may be requested.

Close the transaction. For asset based loans, including equipment or vehicles, a site inspection and pictures or video of the collateral may be required. GPS installation on the equipment is usually a condition of funding vehicles such as trucks and also construction equipment. After reviewing the contracts, if you’re satisfied, complete them. Funding usually takes place within 24 hours by wire transfer or ach deposit.

Customer complaints:

– mca’s too expensive need alternative

– Lower rate mca’s

– Predatory mca’s

– Don’t like mca’s

– Mca’s are too short term

– Need longer term Loan

Many customers just say that they don’t want a cash advance. They need funding but already have an existing mca position and want a longer term up to 36 months.

Alternatives include longer term mca consolidation programs are being offered by some alternative funders to improve or rescue businesses from cash flow emergencies. Make sure you are dealing

with a credible and ethical broker.

What can you substitute?

Substitute an asset based loan program or a real estate cash advance for an mca. It offers longer terms and higher dollar amounts. Consolidation programs offer relief from cash flow emergencies.

What different options are there?

Businesses may qualify for several options that are not daily or weekly repayment loans. For example: Factoring, real estate backed capital, Lines of credit, and asset based.

Need lower rate options? Rates as low as the low teens.

Longer terms:

Most terms are for between 3 and 9 Months, but much longer term options are available. For instance, choose from 12, 13, 14, 15, 16, 17, 18 Months.

Other Choices:

Business have other needs including money to pay for inventory. Consider information on how to get money for product orders. Monthly repayment loans.

Accounts Receivables financing

There are significant benefits to the accounts receivables financing, also known as factoring. The biggest benefit may be that it is not debt. Another big advantage is that they are not really an advance of future receivables. Your company is not getting money now in advance of money it will earn in the future.

In fact, it is the opposite.

Factoring provides money that is already earned and owed, for a relatively small fee, between 1.5% and 5%. There is no daily or weekly payment, since your company is getting money that is due to it.

asset based loans, or a loan against equipment are excellent options. These are almost all monthly repayment and normally begin with terms starting at 12 months to 60 months. Some have even longer terms, especially if they include real estate.

real estate backed loans

Need a business plan and also detail on how to create financial statements? Visit the SBA for assistance.