Lower Rates: MCA Cash Advance

- Contact merchant cash advance companies that offer programs with lower rates that match your business profile.

- Get the rates and terms available from each program.

- Ask in advance if your business profile matches the lower rate programs available. If so, select the best match and apply.

- When approved, review closing contracts and complete the transaction.

- Receive funds deposited into your business checking account and begin a lower repayment.

Call 919-771-4177 for more info.

Your business can get an mca merchant cash advance renewal with lower rates and longer terms by understanding tips on cash advance qualifications and guidelines.

The same programs also offer mca merchant cash advance renewals with rates as low as 12% to 15% and up rate factors and longer terms if your business qualifies.

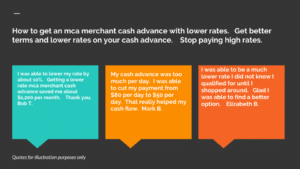

Frequently asked questions FAQ How to get an mca merchant cash advance with lower rates.

How low of a rate can I get?

The lowest rates start at 8% for the best credit, strongest cash flow and longest time in business. Rates in the low teens and higher are more common for most businesses.

Can we switch to a lower rate immediately?

You can by paying it off with a lower rate advance or regular loan. Using the funds from your new funding to payoff the balance on your old advance works especially well when the balance is low.

Can we get a better rate with a regular business loan?

Regular business loans usually do have a lower rate. They may also require a personal credit bureau score of 600 or higher. Time in business of 1 year or longer is needed for lower rate business loans.

Can I get a lower rate line of credit advance? mca merchant cash advance?

There are cash advances you can use like a line of credit. Your business can borrow, repay, and re-borrow repeatedly. You can borrow from the line as soon as 30 to 60 days after closing with good repayment history.

If you would also like to learn more about qualifying for a cash flow loan based on sales in general, or Your Company’s Assets,

please watch the video below.

Other options to get better terms

Consider other loan types such as asset based or longer term loans if your credit score is higher

Increase your personal credit score by review your credit and disputing any inaccuracies

Establish a business credit profile and build business credit

Maintain business financial that show your business has a net profit that is more than any new loan payment you are applying for.

Author Biography: Will Sanio, Owner of SCF Funding, dba SmallBusinessLoansDepot.com, has a Bachelor of Science Degree in Business Administration with a concentration in Finance from the University of Tennessee, Knoxville.

Over 20 Years experience including 10 Years with Wells Fargo, formerly Wachovia Bank and First Atlanta Bank. Specializing in Traditional and Alternative lending.

Follow me and our Videos below!

VIMEO

YOUTUBE

LINKEDIN

TWITTER

https://developers.google.com/profile/u/willsanio

GitHub

StackOveflow